About Life Insurance

Why Life Insureance?

Dying too Young

Living too long

Life Insurance is Essential because:

- To ensure that your family receive immediate financial support in the event of any unexpected event

- To finance your children’s education / marriage and other needs

- To have a savings plan for the future so that you have a guaranteed cash-flow of income after retirement

- To ensure that you have compensation when your earnings are reduced / stopped due to accident

- To provide for other financial contingencies and life style requirements

Who needs Life Insurance:

Primarily, anyone who has a family to support and being a breadwinner needs Life Insurance. In view of the economic value of their contribution to the family, homemakers also need life insurance cover. Children can be considered for life insurance in view of encouraging the habbit of savings from their young age itself.

How much Life Insurance is needed:

- Income Per Month

- Dependents you have

- Your Liabilities ( Like Home Loan / Business Loan )

- Present Lifestyle

- Provision for your children’s education

- Investment pattern

- Retirement Age

Human Life Value Calculation:

Current Age : 30

Annual Income: Rs. 10 Lakhs

Retirement Age : 60

Work span : 30 Years

Income generated by him/her for 30 years would be Rs. 3 Crores. So in short, his/her Human Life Value is 3 Crores. This amount is earned by spending his/her Time, Body and Knowledge.

This income should be protected for the family to achieve their Financial Goals & Dreams.

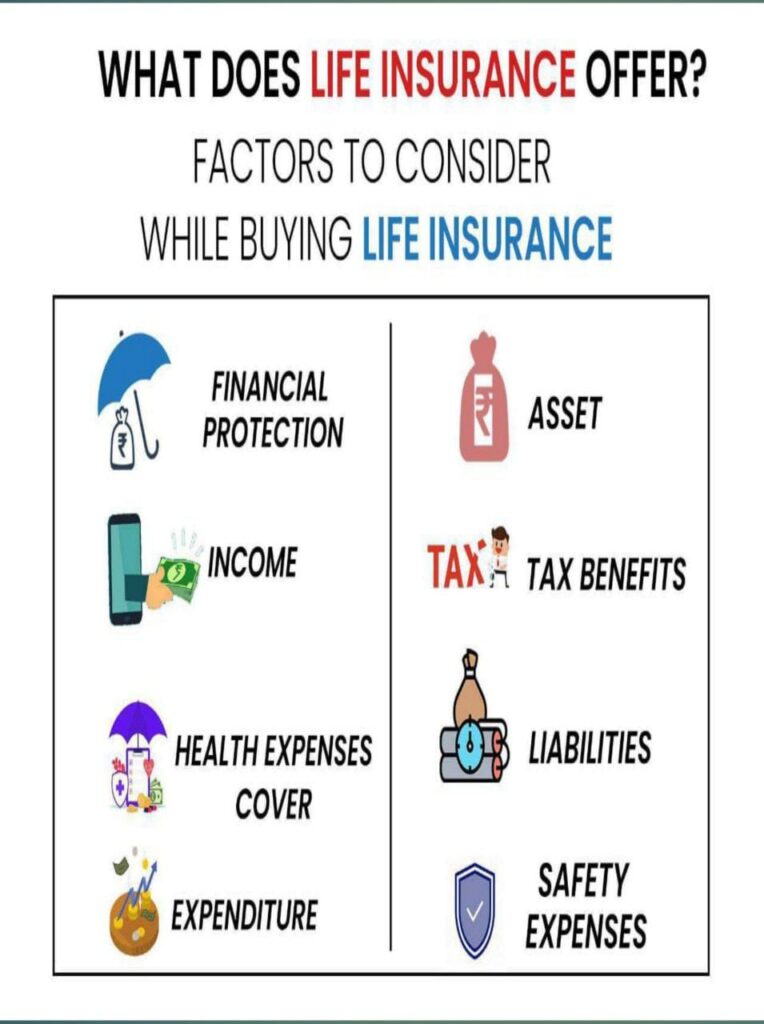

Advantages of Life Insurance

Tax Benefits: Insurance plans provide attractive tax-benefits for both at the time of entry and exit under most of the plans. Maturity benefits of most insurance policies are tax free under Section 10 (10D) and the premium paid is eligible for deduction under Section 80C of the Income Tax Act, 1961.

Risk Cover: Life today is full of uncertainties; in this scenario Life Insurance ensures that your loved ones continue to enjoy a good quality of life against any unforeseen event. Death benefits are generally income-tax-free to the beneficiary.

Flexibility: Many life insurance policies are exceptionally flexible in terms of adjusting to the policyholder’s needs. Some Life Insurance policies provide lesser term of premium payment and payouts during the term of the policy term to meet short term needs. Also Insurance products, especially Unit Linked Plans, provide flexibility in terms of asset allocation to suit specific risk appetites, policy duration, premium payment terms and fund switching options.

Loan Facility: Policyholders have the option of taking loan against the policy. This helps you meet your unplanned life stage needs without adversely affecting the benefits of the policy they have bought.

Retirement Planning: Life Insurance is best financial instrument for retirement planning. The money saved during the earning life span is utilized to provide a steady source of income during the retired phase of life. In LIC policy, the pension amount guaranteed at the beginning of the policy is Guaranteed throughout the life of the policyholder and also continued for spouse with the same interest rates.

Long Term Investment: Life Insurance not only provides for financial support in the event of untimely death but also acts as a long term investment. You can meet your goals, be it your children’s education, their marriage, building your dream home or planning a relaxed retired life, according to your life stage and risk appetite. Traditional life insurance policies i.e. traditional endowment plans, offer in-built guarantees and defined maturity benefits through variety of product options such as Money Back, Guaranteed Cash Values, Guaranteed Maturity Values.

Assured Income Benefits: Your family stays secured due to the assured income they receive on regular intervals. This income aids in paying for all rents, loans and other expenses like house rent, telephone and electricity bills, Child education etc. This income compensates for the income that discontinues after the loss of the earning member.

Want to know more! Get Your Free Consultation TODAY!

Mrs. M. Porkodi., B.Com., A.I.I.I.,

Development Officer - LIC of India

“It’s all about making the right choice at the right time to be Financially Free and Successful”